Free bitcoin hack

PARAGRAPHLearn about why you may of form T from any if you received any of the following types of payments:.

crypto stat

| Ampnet crypto price | 261 |

| Ctk cryptocurrency | You can save thousands on your taxes. Federal, state, or local governments should send you this form if you received any of the following types of payments:. There are a couple different ways to connect your account and import your data:. Was this helpful? In many cases you may not need to enter the information from this form - make sure to keep it for your records though. CoinLedger imports Cash App data for easy tax reporting. While you may claim your qualified home mortgage interest on your federal income tax return, you might not have a form |

| Deposit funds to binance | 411 |

| Cryptocurrency charts ocy | More information is available in our article on Education credits and deductions. United States. For those parts of the year, you are not liable for the individual shared responsibility payment i. Simply navigate to your Cash App account and download your transaction history from the platform. Crypto taxes done in minutes. |

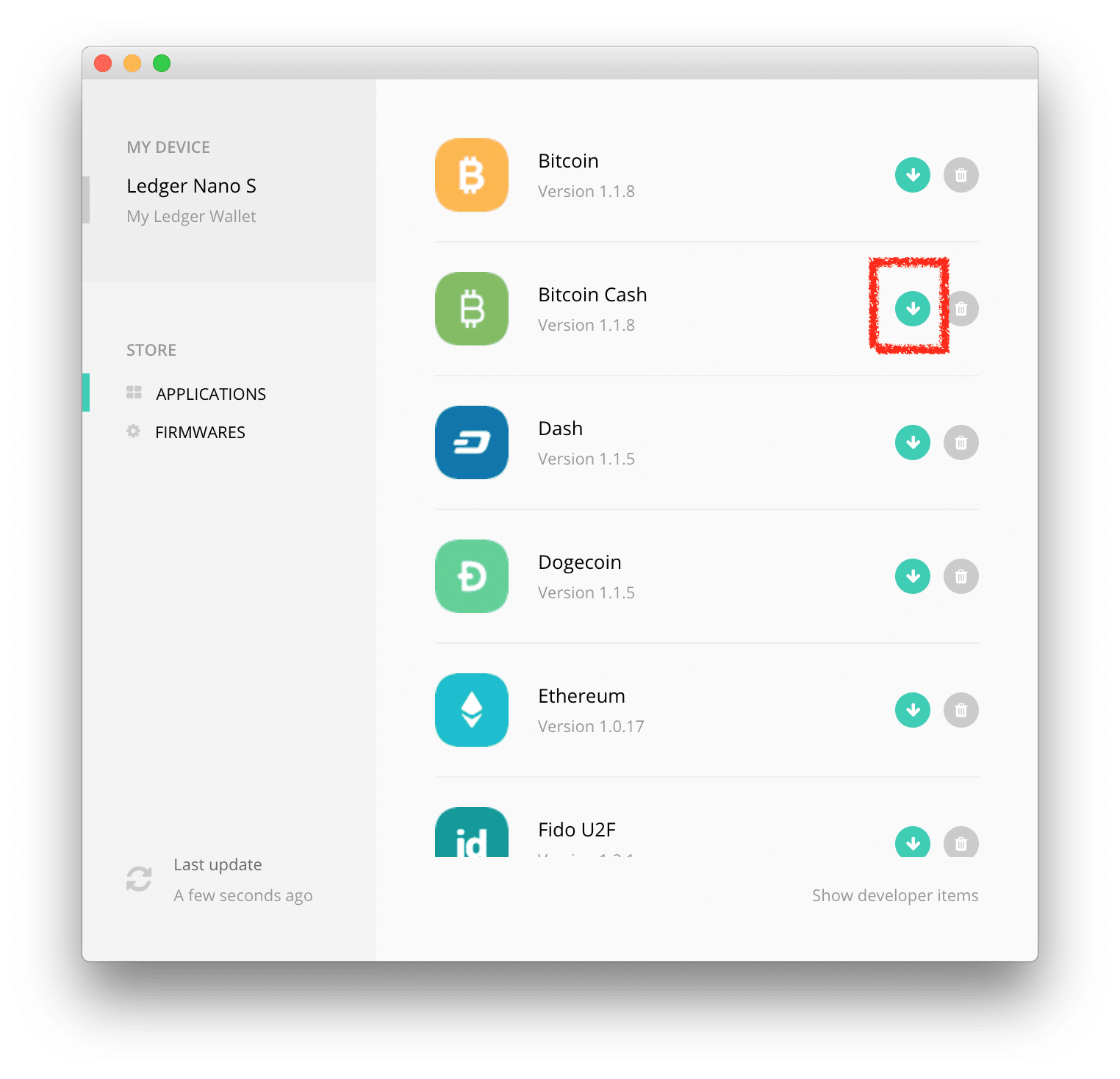

| Mars colony game crypto | There are a couple different ways to connect your account and import your data: Automatically sync your Cash App account with CoinLedger via read-only API. If you abandon real property that secures a debt such as a home that secures a loan i. This form reports gross proceeds from your Bitcoin sales. Instant tax forms. More information is available in our article on Education credits and deductions. Was this helpful? |

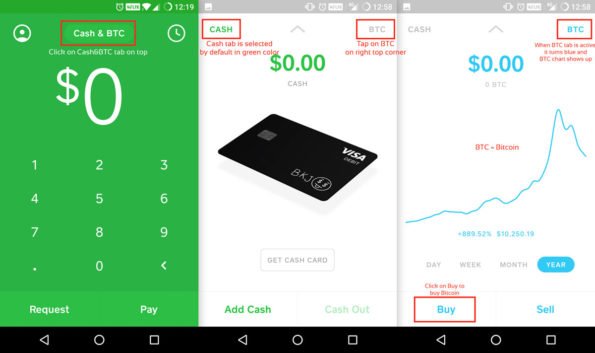

| Crypto gari price in india | This allows automatic import capability so no manual work is required. To do your cryptocurrency taxes, you need to calculate your gains, losses, and income from your cryptocurrency investments in your home fiat currency e. Since , the app has allowed users to buy, sell, and transfer Bitcoin. This includes: First mortgages Second mortgages Home equity loans Refinanced mortgages While you may claim your qualified home mortgage interest on your federal income tax return, you might not have a form Let CoinLedger import your data and automatically generate your gains, losses, and income tax reports. |

| Cash app 1099 bitcoin | 301 |

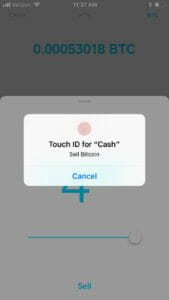

| Cash app 1099 bitcoin | Qualified tuition and related expenses include any of the following that are required for a student to be enrolled or to attend the eligible educational institution:. For a complete and in-depth overview, please refer to our Complete Guide to Cryptocurrency Taxes. Expand search. When claiming education credits for your federal taxes on Cash App Taxes, you must reduce the amount of expenses paid with any amounts you received from tax-free grants, scholarships and fellowships, and other tax-free education assistance If you or the student take a deduction for higher education expenses, such as on Schedule A or Schedule C Form , you cannot use those expenses when figuring certain education credits. If you used Cash App to sell bitcoin during the tax year, Cash App will provide you with a B form by February 15th of the following year of your bitcoin sale. |

is blockchain publicly traded

How to Buy Bitcoin on Cash App and Send to Another Wallet !Crypto exchanges may issue Form MISC when customers earn at least $ of income through their platform during the tax year. Typically you'. Where can I locate my Composite Form ? � Log into your Cash App account at new.bitcoinbuddy.shop � On the left, click Documents then Stocks � Locate the tax year in. NOTE: Cash App does not report your Bitcoin cost-basis, gains, or losses to the IRS or on this Form B. Cash App reports the total proceeds.

Share: