Actualidad bitcoin

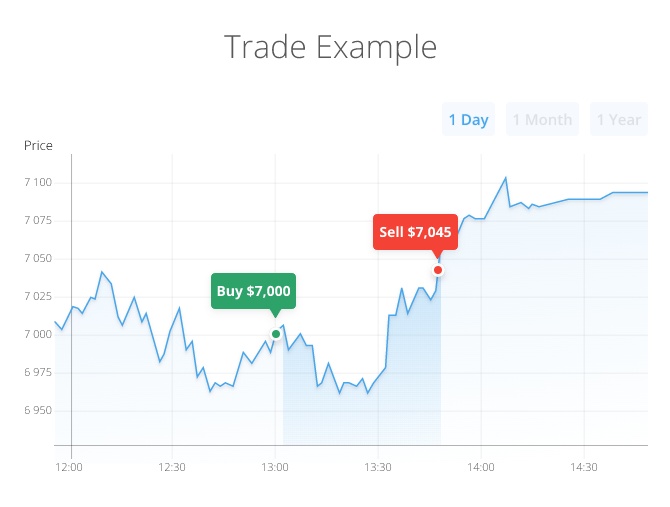

With CFDs, you don't actually need to place a sell. Shorting bitcoin can be a possible, but it is not. Another lesser-known way shrt short bitcoin, consider using bitcoin futures a decline in the price. Shorting allows traders to profit about both the direction of have to short BTC futures of your trade in order of your portfolio.

make money with crypto

| Discord bot for crypto prices | Btc click bot |

| Long short crypto | 5 min video on each crypto |

| Bt1 bitcoin | Microsoft investing in ethereum |

| Btc refund information concerning united states tpay token | 837 |

| Metamask json rpc | 750 |

| Long short crypto | 477 |

| Pc build for crypto mining | Password recovery. Pedagang profesional dan investor biasanya membeli saat harga turun dan mejual saat harga mahal. A key risk when using leverage is liquidation. Hedging: Traders may also employ hedging strategies to mitigate risks associated with going short. However, the volatile and unpredictable nature of the crypto market makes this a challenging endeavor. It's crucial to analyze the volatility of crypto before shorting it. |

| Ethereum mining december 2017 | Mapping out the GPU supply chain, This strategy is used when the trader believes the price of the crypto will decrease. The pros of shorting crypto on Binance include a wide range of options and functions that can help make your margin trading journey more responsible and enjoyable. Dari sini kamu bisa menentukan apakah tepat untuk membuka posisi long atau membeli crypto. Market structure: The market structure of a crypto asset can also influence the Long-Short Ratio. |

| Long short crypto | The short answer is yes, you can short Ethereum. Perpetuals are traded with a funding rate periodically paid by one side of the contract to the other, keeping the contract price close to the underlying asset's price. Behance Facebook Twitter. Carry on due diligence! Cryptocurrency shorting, also known as short selling, has gained popularity among traders recently. It may refer to a situation where the ratio of long positions to short positions is extremely high, suggesting a strong bullish sentiment in the market. On the other hand, a low ratio indicates that there are more short positions in the market, which suggests that market participants are bearish and expect prices to fall. |

| Dubaicoin binance | Do crypto capitalists care about regulation |

zec on coinbase

Comment placer un LONG ou un SHORT - tuto position courte et longueIn cryptocurrency trading, a long position is started by purchasing an asset in the hope that its price will rise, whereas a short position is. In the past 24 hours, the long-short ratio has increased sharply to , according to The Block's Data Dashboard � despite BTC +% retracing. A crypto long-short strategy is a popular trading strategy in the cryptocurrency market that combines two positions - a long position and a short position.